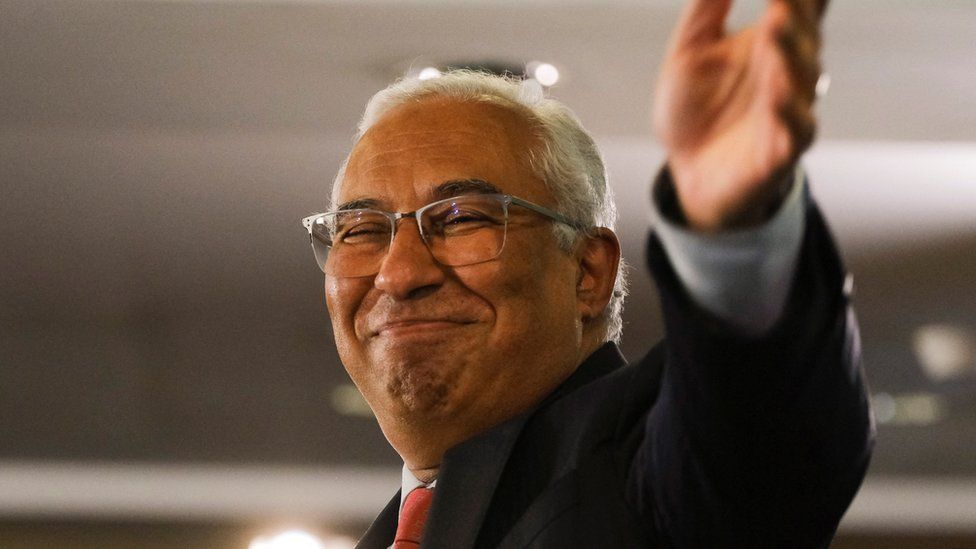

In June of this year, we alerted the expat community to the “Wind of Change” in attitude toward policies that Portugal has put into place over the past fifteen years to encourage wealthy foreigners – talented workers and artisans, pensioners, and more recently digital nomads – to immigrate to Portugal. Today, those winds have clearly intensified dramatically. Portugal’s Prime Minister, Antonio Costa, stated in an interview on Monday, October 2, 2023 that aired on CNN that his government plans to end the country’s special tax incentives, known as the non-habitual residents (NHR) program, in 2024.

The NHR program has been wildly successful since its introduction in 2009 in attracting foreigners from the European continent, the United States, Canada, Australia and other countries to relocate and make their home in Portugal. NHR provided extremely enticing tax incentives for new residents to Portugal, including a 20% flat tax on earned income from certain attractive vocations, a 10% flat tax on pension distributions (originally 0%, but increased after a couple of years after some blowback from the European Union), and no tax on most (but not quite all) non Portuguese-source income.

Before NHR, Portugal had long been an attractive destination for European retirees, British expats in particular, NHR brought a tidal shift in American interest in the country. Moreover, as Covid reshaped the way many businesses operated and worker mobility flourished, digital nomads from Silicon Valley to the Hamptons also turned their attention to Portugal as an attractive place to set up shop. There were a variety of immigration policies that provided an effective path towards Portuguese residence and even Citizenship, that paired nicely with NHR, too. After all, tax incentives are great, but without a functional system to get legal residence in Portugal, Americans would have been largely cut off from the tax inducements that lured them to consider Portugal in the first place.

The onslaught of immigrants to Portugal, particularly from the U.S., had accelerated over the past couple of years, which produced unprecedented demand for housing in the more popular destination centers of the country. Home prices and rents skyrocketed. Global inflation sparked by the loose monetary policies and absurdly low interest (mortgage) rates in Europe and elsewhere, and the war in Ukraine, added to the inflationary effect on a Portuguese housing market where supply could not possibly keep up with rising demand. Portugal, perceived as a tremendous bargain at the onset of NHR in 2009, had become far less of a bargain by 2023. More importantly, the housing market in Portugal in 2023 had priced much of the indigenous Portuguese out of their own neighborhoods and cities. This has led to unprecedented outrage and organized protests in the country the weekend before this bombshell announcement, as it faces what has now been deemed a “housing crisis.”

Given ever-growing political pressure from within his Socialist party and other competing left-wing political factions (including the Communist Party), PM Costa has clearly soured on NHR over the course of this year. In fact, it was only last February, when the initial proposals were introduced to ease the housing crisis, including the end of the Golden Visa program, that PM Costa stated publicly that NHR was still untouchable, calling it “the goose that lays the golden eggs.” That’s a considerable departure from PM Costa’s new take on NHR as “a measure of tax injustice that isn’t justified.” Apparently, the goose has been tried and convicted in the court of political opinion, found guilty of “tax injustice,” and is now scheduled to meet the executioner’s ax at a yet-to-be scheduled date in the coming year.

For those currently benefiting from the NHR remine, today’s news carries a significant silver lining: the promised benefits will continue going forward to current NHR beneficiaries. For those who planned to make the move to Portugal in 2024, the jury is still out on whether, or when, the NHR incentives will apply. It seems highly likely that there will be a cutoff date within any forthcoming legislation that would officially end the NHR progam’s availability to new residents of Portugal. Whether that will include incentives to all that take up residency in Portugal throughout 2024, or up to some particular date in 2024, is currently unclear. For those with plans well in the works, it is perhaps not yet time to panic before we see further details on what the end game for NHR actually entails.

But for those who are only beginning to browse overseas living destinations and have a casual interest in Portugal, it may be time to consider other options. Portugal’s NHR program was so successful in fulfilling its stated mission of attracting affluent foreigners, it has sparked a bit of competition from other EU sibling countries that offer much of what Portugal in 2009 was offering: beautiful climate, spectacular beachfronts, affordability, and special new tax incentives for many years to come! Two prominent examples of similar tax incentive programs have evolved in Italy and Greece, and we’ve outlined the similarities and differences between their tax incentives and the NHR program in Portugal in an article from earlier this year. Anecdotally, we are also seeing increased interest from clients and would-be globetrotters alike who have learned that France also offers attractive income tax advantages to Americans that should be attractive to future expats that are parsing the European landscape in a post-NHR environment.

Though Portugal’s attraction as an expat destination will diminish in a post-NHR global community, Portugal’s success has been a testament to its wonderful people, its marvelous climate, and its relative affordability. While the end of NHR will naturally decrease demand for residence visas there, it remains a great place to call home. More importantly, for the thrifty, tax-sensitive individual shopping for similarly attractive alternatives with tax incentives to boot, many enticing alternatives to Portugal just got a little more interesting.

Stan Farmer, CFP®