It is a (relatively) good problem to have: whether it is because of a bonus, diligent savings or unexpected windfall, you’ve accumulated extra cash reserves in your local currency. The question then becomes how to handle these reserves. While we can not answer every question related to cash management, we believe that there are two fundamental questions in order to help with these decisions.

-When do you need it?

-In what currency will you be spending it?

If the answer to the first question is “sometime in the future” then the best decision is to invest it in a diversified portfolio, which for most Americans abroad is best done in a US-based Brokerage Account as investing outside of the US presents all sorts of tax issues and compliance risks for Americans abroad (see https://usexpatinvesting.com/wp-content/uploads/2020/04/US-Expat-Investing-Guide.pdf podcast on PFICs). If, however, the timeline is shorter (a car next year? A house in 2 years?)Americans abroad will want to take a closer look at their situation.

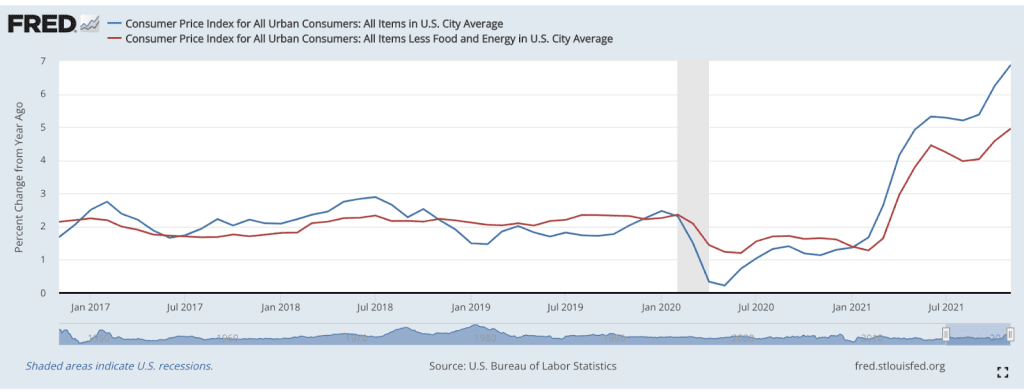

In the previous few years, interest rates increased in the US slightly faster than those in the rest of the world, and as a result many Americans abroad were wondering whether they should invest these cash reserves in US bank accounts or other cash based savings vehicles (CDs, etc.) rather than those in their home countries.

The first item to be aware of is that this introduces exchange rate risk into the equation in a way that does not affect clients who keep and spend their funds in the same currency. The possibility of currency risk in the near term should not be overlooked: according to statistics assembled from macrotrends.com (https://www.macrotrends.net/2548/euro-dollar-exchange-rate-historical-chart), on average the usd and euro pair have averaged a fluctuation (in either direction) of 7.5% per annum in the last ten years. While such a fluctuation can prove valuable should the US dollar increase against the local currency (your funds are worth the higher interest rate PLUS your exchange rate gain), it can also mean any gains from that extra 1% you are earning are not only eliminated, but there is a significant chance you could lose money in your local currency.

However, good news is that in 2023, interest rates have moved up in most of the rest of the world. For example, The ECB (European Central Bank), has in the last year increased its interest rates from approximately 0.0% to 4.25% (https://tradingeconomics.com/euro-area/interest-rate) a move which has made interest rates in Europe much more competitive overall (similar moves have also taken place in the UK and elsewhere around the world). Consequently, Americans abroad might want to take a closer look at offerings like CDs or high yield savings accounts from their local bank, or investigate purchasing government bonds (especially if they live in a generally safe large economy).

While Americans abroad will likely have to pay tax on these interest earnings in the US (or use tax credits because they paid tax on the earnings in their local country), these items will not have any PFIC reporting requirements. Additionally, investors should be aware that the standard protections that many Americans assume for their US banking relationships (for example, FDIC insurance) may not exist in their country of residence.

Ultimately, this brief article cannot eliminate the chance you will lose money or make the best decision for your individual situation, it should highlight the significant questions you should ask yourself before deciding how to allocate cash reserves as an American abroad.

You should always consult a financial, tax, or legal professional familiar about your unique circumstances before making any financial decisions. This material is intended for educational purposes only. Nothing in this material constitutes a solicitation for the sale or purchase of any securities. Any mentioned rates of return are historical or hypothetical in nature and are not a guarantee of future returns. Past performance does not guarantee future performance. Future returns may be lower or higher. Investments involve risk. Investment values will fluctuate with market conditions, and security positions, when sold, may be worth less or more than their original cost.