We have all heard the overused phrase “new normal” too often. Pundits and media types love to tell us that this is a different time, situation, or environment than we have ever seen before. I tend to look skeptically at these prognostications because history has a way of repeating itself. All of that said, we are all finding our footing in the soon-to-be post-Covid lockdown period. It will feel strange to eat in a restaurant or shop in a store without wearing a mask. This will not, however, be a new normal as much as a move toward “back to normal,” not only in our personal and social lives but also in our financial lives.

Savings Rates on the Rise

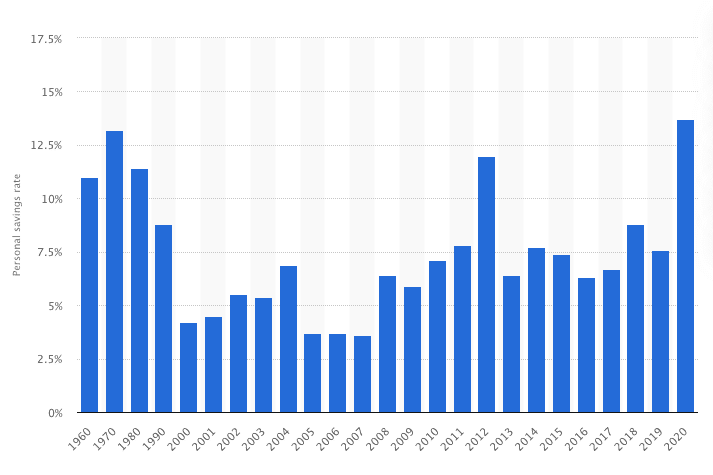

We all were forced to adjust our lives and adapt to a Covid world. We all stayed at home more and limited our exposure to populated situations. A silver lining emerged from this very difficult period in our lives by way of our personal savings rates. Personal savings rates in the United States skyrocketed in 2020. The savings rate in 2020 was almost double that of 2019 and more than doubled the respective rates of 2016 and 2017. This was the direct result of our travel and discretionary spending being greatly restricted; therefore, most people changed their spending habits without necessarily trying to change their spending habits. We didn’t intentionally tighten our budgets. More so, our budgets were tightened for us. For this reason, we need to be cognizant of how our budgets are likely to change again in the post-Covid world.

In the chart above, 2020 became one of only two years since 2000 that Americans’ personal savings rate eclipsed 10%. Click here for the interactive chart. Source: Statista.com.

Pitfalls on the Move Back To Normal

Our economy is emerging from the past 15 months and the US consumer appears ready to spend again. The travel statistics in the U.S., while still low, are strongly rebounding, with nearly nine in 10 Americans preparing to travel in the next six months. Bars and restaurants are also seeing foot traffic slowing moving back to pre-Covid levels. All of this means one thing for our finances – plan or deal with the consequences. We will likely experience myriad influences over the coming months, including the lack of a spending budget and the desire to do everything we couldn’t during Covid – all at once. These can cause major problems to our monthly budget. We should anticipate an increase in our discretionary spending and plan for it. Make a conscious decision to set a monthly budget for spending on dining out, entertainment, and travel.

We should also be aware of the desire to make up for the lost time. For many of us, we haven’t seen a concert, attended a live event, or traveled on vacation in roughly a year and a half. We should fight the urge to make up for that in the next six months. Spread out those more costly, splurge-type purchases over the next year or two. It is important to establish a dedicated travel line item into our budget. This will make it much easier to control those costs.

Assess Your Financial Situation

Your financial life is in a different place than it was at the beginning of 2020. Many people have experienced a job change or an increased balance in their cash reserves. Now is the time to re-examine your financial goals and meet with your financial advisor. You may have a former 401k to roll over or room in your existing employer-sponsored retirement plan for additional contributions. The investment markets are in a significantly different place than they were 15 months ago, as well. Have you rebalanced your investment allocation since the pandemic started? Investors should determine if their risk profile has changed. Life events that are the size, depth, and breadth of Covid-19 change us individually and can easily have an impact on our view of risk. For all of these reasons and many more, you should book an appointment with your financial advisor and update your financial plan. If you do not have a financial plan, feel free to reach out to Walkner Condon.