The 3rd quarter provided strong returns for risk assets across the board. In spite of continued investor anxiety about COVID and the upcoming elections, the S&P 500 finished the quarter up 8.9%, the Russell 2000 up 4.9%%, and the broad global markets up 8.1%. In the fixed income space, the US 10-year rate rose 3 basis points to 0.69%, while the US dollar continued its softening trend versus other currencies, with the DXY index down 3.6%. The Bloomberg commodity index rose 9%.

While market commentators have focused their attention on COVID and the elections, if price action is any guide, investors have their sight set on a much loftier concern: clean energy.

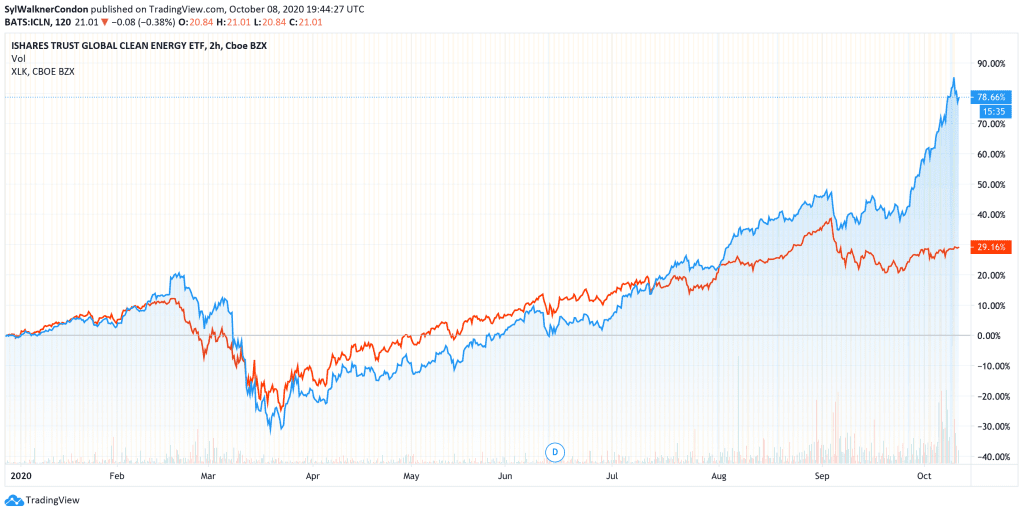

One of this year’s biggest market stories has been the seemingly unstoppable rise of Tesla, but the latest clean energy craze also benefited much less glamorous names such as Sunrun (up 290% in Q3), Enphase Energy (up 73% this quarter) or Vestas Wind Systems (up 52%…) . What these stocks have in common is their involvement in the production of solar, wind and other renewable energy sources. The entire sector has been on a tear: S&P Global Clean Energy Index, which tracks a basket of 30 clean energy names and can be seen as a proxy for investor sentiment, is up 47.6% in Q3 alone, outperforming even the red-hot technology sector year-to-date:

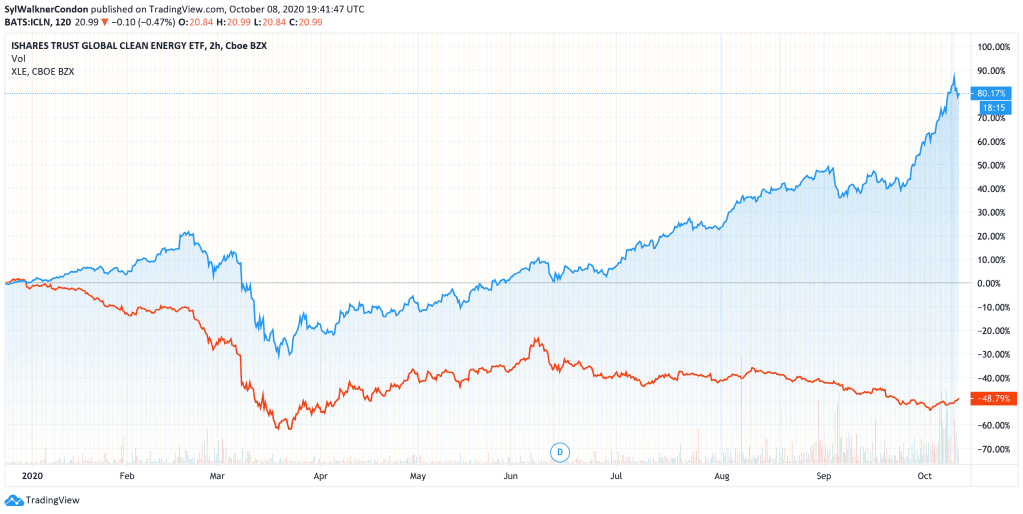

The contrast is most striking when compared to the traditional energy sector (oil and gas), which is down 20.8% in Q3 alone:

Looking at the chart above, one might almost get the feeling that a true energy revolution is unfolding before our eyes, but that’s not quite the case: the S&P Global Clean Energy Index remains a small, niche, segment of the market. That said, the enthusiasm is real, and so is the market’s disdain for the traditional, “dirty”, energy space.

Goehring & Rozencwajg, an investment firm specializing in the natural resources space, highlighted in their recent market report [1] that the share of energy stocks as a proportion of the total market has been declining for years and even decades. In 1980, the energy sector peaked at around 35% of the S&P 500’s market capitalization. In 2008 it was about 15%. After this year’s rout, oil and gas now represents a measly 2% of the index.

For such a key strategic resource, it’s amazing to think that oil and gas are now little more than a rounding error in the average investor portfolio. I asked Adam Rozencwajg if they had ever seen a time when oil was this hated in their team’s 30-year experience of energy investing “no, never” he said, “I don’t think it’s been this hated since Colonel Drake drilled the first American oil well in 1858”.

The energy transition theme is not new, and could be one of mega trends that will shape the future of the global economy. Electrification (and “decarbonization”) is the idea of replacing traditional petroleum-based energy sources with clean electric alternatives: Imagine leaving your solar-powered home in the morning and driving your electric car to go work in a wind-turbine-powered office building. As far removed as it may seem from our daily realities, this is the dream of a successful transition to cleaner energy. Some have even made the case that, with a bit of help from nuclear power, America could be fully electrified right now [2][3].

The market has seen clean energy crazes before. In the heyday of the pre-2008 bull market, clean energy was one of the hot sectors. At the time, a massive influx of government and VC money sent valuations soaring. Eventually, misallocation of capital and technological shortcomings brought the “green bubble” to an abrupt end (see Juliet Eilperin’s 2012 article on the topic “Why the Clean Tech Boom Went Bust” [4], for a good post-mortem on the topic). Today, the prospect of a Biden presidency and his ambitious “Plan for an energy revolution” [5] is without a doubt contributing to the sector’s renewed hope, but real-life solutions, beyond campaign promises, will be urgently needed to sustain the trend, or the dream of an electric future will remain just that.

Syl Michelin, CFA

[1] Goehring & Rozencwajg – Top reasons to consider oil related equities

http://info.gorozen.com/top-reasons-to-consider-oil-related-equities

[2] America Could Go Fully Electric Right Now – Irina Slav

https://oilprice.com/Energy/Crude-Oil/America-Could-Go-Fully-Electric-Right-Now.html

[3] Mobilizing for a zero carbon America – Saul Griffith, Sam Calisch

[4] Why the Clean Tech Boom Went Bust – Juliet Eilperin

https://www.wired.com/2012/01/ff_solyndra/

Disclosure: The charts and any returns illustrated on this blog post are for informational purposes only. This is not a solicitation or offer to purchase any of the securities listed above. Before making any investment decisions, including buying any stocks listed above, you should consider your risk tolerance and objectives. Check with a licensed professional before you act. Past performance is not an indication of future results.